All posts and charts are for educational and illustration purposes only

Wednesday, November 29, 2017

Yangzijiang - Testing the 50 Days Moving Average Again . Will it give way?

Yangzijiang - Testing the 50 Days Moving Average Again! Since beginning of the year been the 50 days MA has proven to be a reliable support. This time round Price Action is suggesting that it could be breached. The next crucial support is 1.48 and 1.40 respectively.

Monday, November 27, 2017

Shanghai A share Index - Sign of Topping Out In the Short Term

Uptrend breached today! Asia market especially Hang Seng has been tracking the Shanghai A share index closely lately. More weakness ahead for China A shares does not augur well for the regional stocks indices.

All posts and charts are for educational and illustration purposes only

Jumbo - Earnings below estimate , higher dividend did not help share price

Jumbo - FY 17 earnings below estimates dampened by higher operating cost. Faster expansion plan incurring higher capex will be a key risk if it fails to deliver growth. The increased dividend to 1.2c did not help to boost the sentiment. On the charts , its heading for its next support at 0.525 and a break below this level will take the share price down to 0.47.

All posts and charts are for educational and illustration purposes only

DLC Webcast for the Week of 27 Nov 2017

Robin's weekly DLC webcast for the week of 27 November in collaboration with Soc Gen is online!

You can watch it via this link:

https://www.tradingkungfu.com/livetrading/

All posts and charts are for educational and illustration purposes only

Wednesday, November 22, 2017

Monday, November 20, 2017

Robin's Weekly Webcast about Hang Seng Index with the DLC

Robin's weekly DLC webcast in collaboration with Soc Gen is online!

You can watch it via this link:

https://www.tradingkungfu.com/livetrading/

All posts and charts are for educational and illustration purposes only

Monday, November 13, 2017

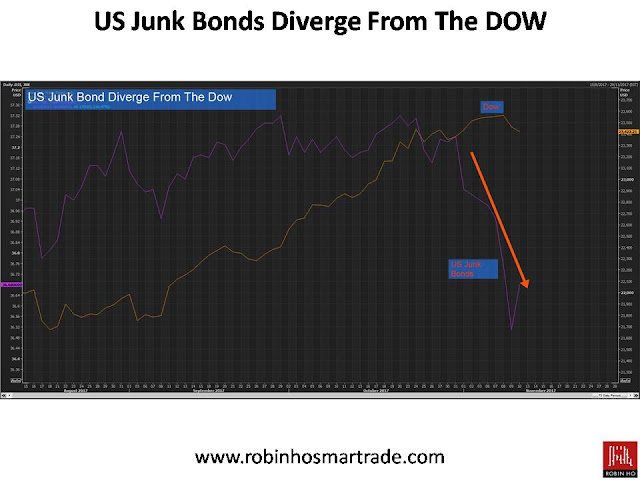

Junk Bonds Collapsed, Diverging From Dow - Another Canary In The Coal Mine?

Junk Bonds and Stocks are usually positively correlated, or move in the same direction, because Junk Bonds are considered a proxy for risk appetite in the market. It started to diverge in late October. Is it another canary in the coal mine - an ominous sign of an impending market correction coming?

All posts and charts are for educational and illustration purposes only

Watch Robin's Hang Seng Index DLC Webcast Online

Robin's second DLC webcast in collaboration with Soc Gen is online! You can check out the video via the link below to watch Robin share his views about Hang Seng Index.

The next webcast will be taking place Monday at 1pm. Stay tuned!

All posts and charts are for educational and illustration purposes only

Thursday, November 9, 2017

Best World - Prediction on 7 Nov was Spot On

Two days ago, this blog predicted that Best World could correct to 1.25. Today Best World's closing price is 1.26.

Best World's 5-minute chart shows that its price moved almost exactly according to the 7 November trade plan published in this blog post.

All posts and charts are for educational and illustration purposes only

Wednesday, November 8, 2017

Weekly SocGen DLC Webcast Starring Robin Ho

Robin will be live every Monday, sharing his views on the Hang Seng Index as well as the Singapore MSCI Index! Be sure to watch it here:

www.tradingkungfu.com/livetrading/

All posts and charts are for educational and illustration purposes only

Russell 2000 and Dow Diverge

Russell 2000 and Dow Diverge. Ïs it "A canary In A Coal Mine" Syndrome? The Small Caps has started to gave way while the Big Blues are forming tops!

All posts and charts are for educational and illustration purposes only

Tuesday, November 7, 2017

Best World - Weakness Before 3Q results tomorrow. Buying opportunity or an "Ominous"Sign?

Best World - . In August this stock survived a China Goverment crackdown on "Pyramid Scheme" . After plunging from 1.64 to 0.95, its has since recovered to 1.50. Today, it fell ahead of 3Q results on 8 Nov due after trading hour. Is this another "Flushed" the BB is using to collect more stock for a good set of results or an " Ominous" sign of bad news in the making?

Well, from the price action today things certain don't look promising with selling persisting throughout the day on significantly high volume of 9m shares . This weakness came on a bullish backdrop with STI gaining nearly 1%. From the charts , it close below its strong support of 1.42 and could head towards its next stop at 1.30 and 1.25. If the results is significantly below expectation 1.10 is on the cards.

A spillover of the China's campaign on illegal pyramid schemes and high Capex cost from building new manufacturing plants could cause a drag to its revenue.

Well, from the price action today things certain don't look promising with selling persisting throughout the day on significantly high volume of 9m shares . This weakness came on a bullish backdrop with STI gaining nearly 1%. From the charts , it close below its strong support of 1.42 and could head towards its next stop at 1.30 and 1.25. If the results is significantly below expectation 1.10 is on the cards.

A spillover of the China's campaign on illegal pyramid schemes and high Capex cost from building new manufacturing plants could cause a drag to its revenue.

All posts and charts are for educational and illustration purposes only

Monday, November 6, 2017

DLC Live Webcast with Robin - HSI and SIMSCI Outlook

*Update:

The first live interview with Soc Gen went smoothly! If you have missed the live webcast, you can still watch the 10 minute video via the same link below.

Robin will be sharing his views on the program every Monday at 1pm, so stay tuned!

Robin will be sharing his views about Hang Seng and SIMSCI on Societe Generale Webcast today! You can watch the web streaming here at about 1pm:

All posts and charts are for educational and illustration purposes only

Friday, November 3, 2017

CityNeon - Excitement Over Jurassic World Could Be Over

Cityneon - Excitement over Jurassic World , the Mighty Avengers and Transformer property rights may be coming to an end. Price action suggest BB made exit between 1.20-1.22. A break below 1.12 will trigger an acceleration to 1.075 and eventually 0.98.

All posts and charts are for educational and illustration purposes only

Wednesday, November 1, 2017

ISDN - A Laggard Engineering Solutions Play Ready For Rebound

ISDN - A laggard integrated engineering solution play with Foxconn and AEM as their major customers. The group is a market leader in motion control with high barrier of entry. It is also a beneficiary of the One Belt One Road project linked with state owned companies. 3Q results is due in mid Nov On the chart it seems to have found a bottom at 0.23 and ready to break out of its consolidation zone between 0.23 and 0.26. A break above 0.26 could see the stock accelerate towards 0.285 and 0.31.

All posts and charts are for educational and illustration purposes only

Subscribe to:

Posts (Atom)