All posts and charts are for educational and illustration purposes only

Wednesday, May 30, 2018

Genting Spore - Cancellation Of Spore-KL High Speed Railway project could impact the stock negatively in the longer term

Genting S'pore - Mahartir's decision to cancel the High Speed Rail project could negatively impact Genting in the longer term. When Genting Hotel Jurong was built , many analyst questioned the relevant of the 557 room hotel built in a place with little human traffic to serve guest from Resorts World Sentosa. When the bilateral agreement for the HSR project was signed on 13 December 2016, this blog understood the reason . If the Genting Hotel was built with the sole purpose of benefiting from the HSR, it will be hard to imagine how Genting Singapore will not suffer from the cancellation of the HSR . On the charts , this stock looks like its has peaked at 1.32, a break below 1.23 could see the price acelerating down to 1.13 and 1.04 .

RHO Key Levels Prediction (new)

A few days ago, we launched the RHO Key Levels prediction of the major indices of the world.

The signals are currently made available (subscription fees waived for a limited period) for members of DLC Interest Group, as well as Robin's clients who are trading indices through their POEMS trading account.

Attached below are some of the projections published in the last two days.

To know more on how to incorporate the RHO Key Levels signals in your trading plan, join us for the next DLC Interest Group meet up on 16 June 2018. See you there!

The signals are currently made available (subscription fees waived for a limited period) for members of DLC Interest Group, as well as Robin's clients who are trading indices through their POEMS trading account.

Attached below are some of the projections published in the last two days.

To know more on how to incorporate the RHO Key Levels signals in your trading plan, join us for the next DLC Interest Group meet up on 16 June 2018. See you there!

All posts and charts are for educational and illustration purposes only

Monday, May 28, 2018

News of US and North Korea Summit supports the market - DLC Webcast 28 May 2018

In this week's webcast, Robin shares his global market outlook, as well as trade plans for Hang Seng Index and Hang Seng Index DLC.

You may catch the webcast here:

You may catch the webcast here:

All posts and charts are for educational and illustration purposes only

Thursday, May 24, 2018

Gold - Ripe For A Rebound!

Gold - Could Be Ripe For A Rebound to 1308 and if able to stay above 1308 it may head for 1320!

All posts and charts are for educational and illustration purposes only

Tuesday, May 22, 2018

China Sunsine - Tailwinds May Be Fading!

China SunSine - One of the best performing stock in the last 12 months rising from 0.60 to 1.63 on the back of strong demand from the automobile industry for its rubber acelerator. This blog believes that with rising oil prices the headwinds may be growing. Over the last 3 years cheap oil has rejuvenated its competitive position, leading to peak margin amid a healthy macro economic environment. Raw material cost accounted for 80-85% of the cost of sales. Key raw material are made from crude oil by product such as benzene. Higher cost of raw material will eat into profit. Generally . selling prices and cost of sales per tonne tracks the crude oil subject to a lag of one month. On the chart a break below support of 1.47 and 1.44 will trigger a downward slide down to 1.37 and 1.26.

All posts and charts are for educational and illustration purposes only

Monday, May 21, 2018

[Video] Highlights of 1st DLC Meetup on 5 May 2018

Here are the highlights of our 1st DLC Meetup on 5th May 2018. Enjoy the video!

The Direct Leverage Certificate is an innovative new product that started trading on the Singapore Exchange last year. More and more traders are starting to trade the DLC as it offers the liquidity, volatility and leverage traders need to excel in the market. To find out more, join us for our next monthly DLC meet up, details below.

Next DLC Meetup:

Date: 16 June 2018, Saturday

Time: 9am-12noon

Venue: SGX Auditorium

Registration: https://www.tradingkungfu.com/dlcmeetup

All posts and charts are for educational and illustration purposes only

Saturday, May 19, 2018

Why Major Stock Markets Seems Calm In the Face Of US Ten Years Treasuries breaking above at the significant 3 % level!

U.S. bond yields broke above the significant 3% and above the 30 years downtrend channel , the highest in seven years, oil is up to $80 a barrel and USD dollar rallying causing emerging markets to post the most significant correction in recent memory and major stock market looks unfazed: . What are the possible reasons ? The much anticpated 3 percent Treasury yield was already priced in, expectation of US. tax cuts

boosting earnings and share buybacks, , a sense

a , and a belief that the turmoil

in the emerging world is isolated to highly leverage countries.

All posts and charts are for educational and illustration purposes only

Thursday, May 17, 2018

US 10 Years Treasury Yield - Breaking Upwards After 30 years

After US 10 Years Treasury Broke Above

the 30 Years Downtrend – Get Ready For A

Prolong Rise In Interest Rates

The

U.S. bond market is at a turning point , Treasury 10-year yield jumped to the highest

since 2011, making

a convincing break above 3 percent, paving the way for a more prolonged rise in

U.S. borrowing cost, after release of solid U.S.

retail sales data with a strong upward .The

market bets that the Federal Reserve will boost interest

rates three more times in 2018. Treasuries have been under pressure from a

flood of new issuance as the US budget deficits widen. And inflation

expectations are hovering near the highest since 2014, after years of doubts

about whether prices and wages would increase. The dollar rallied, pushing it to its highest level this

year and for

the first time in a decade. Trillions of dollars of loans around the

world, especially in emerging markets, are tied to U.S. yields and the dollar.

The US 10 Years Treasury broke above the 25 years downtrend channel , and to

many chart follower marks a major

reversal of trend and cash is winning back it’s appeal .

The

U.S. bond market is at a turning point , Treasury 10-year yield jumped to the highest

since 2011, making

a convincing break above 3 percent, paving the way for a more prolonged rise in

U.S. borrowing cost, after release of solid U.S.

retail sales data with a strong upward .The

market bets that the Federal Reserve will boost interest

rates three more times in 2018. Treasuries have been under pressure from a

flood of new issuance as the US budget deficits widen. And inflation

expectations are hovering near the highest since 2014, after years of doubts

about whether prices and wages would increase. The dollar rallied, pushing it to its highest level this

year and for

the first time in a decade. Trillions of dollars of loans around the

world, especially in emerging markets, are tied to U.S. yields and the dollar.

The US 10 Years Treasury broke above the 25 years downtrend channel , and to

many chart follower marks a major

reversal of trend and cash is winning back it’s appeal .All posts and charts are for educational and illustration purposes only

Tuesday, May 15, 2018

Best World - Prediction on 17 Apr that price will fall from 1.61 to 1.35 was spot on! The price levels unfolded like clockwork!

Best World - 18 Apr Prediction that Best World will fall from 1.60 to 1.35 was Spot On . The precision a of Price Action Tradeplan went like clock work The prediction of how the price level will play out from 1.61 to 1.35 was amazingly accurate. The predited support/resistance price level unfolded like clockwork.

All posts and charts are for educational and illustration purposes only

Saturday, May 12, 2018

S & P - Breaking Out of the Descending Trendline on the Triangle Pattern is a Bullish Signal! Could it be a false break?

S&P - While breaking above the ascending triangle pattern is a bullish signal , but the similiarity of the 2 trend cycle shown in the chart looks presents the possibility of a false break out. For the short term 2700 remains a good support and 2740 a strong resistance. Whatever the outcome, its better to watch and react to the unfolding price action!

All posts and charts are for educational and illustration purposes only

Tuesday, May 8, 2018

Dow Jones - The Fight Is On!

DOW - The Bull and Bear In Trench Warfare

The Bull and Bears have been engaging in a battle for control in the traingular arena. The Dow has rebounded from the ascending trendline numerous time since Feb 18, staying above the 200 days MA. The direction it breaks will set the tone for the next major move, Traders are better off not trying to impose thier view on the market, listen carefully to what the price action tell you and wait patiently for the break. This blog has been calling for the end of the bull market since Feb and naturally expects the Dow to break to the downside . A break below this ascending triangle could be long term bearish and could drive it to its next immediate support at 22650

The Bull and Bears have been engaging in a battle for control in the traingular arena. The Dow has rebounded from the ascending trendline numerous time since Feb 18, staying above the 200 days MA. The direction it breaks will set the tone for the next major move, Traders are better off not trying to impose thier view on the market, listen carefully to what the price action tell you and wait patiently for the break. This blog has been calling for the end of the bull market since Feb and naturally expects the Dow to break to the downside . A break below this ascending triangle could be long term bearish and could drive it to its next immediate support at 22650

All posts and charts are for educational and illustration purposes only

ST Engineering - Due For A rebound and Coming 1Q Results Looks Good

ST Engineering - 1Q18 earnings due this Friday(am). Company guided for smart city and marine revenue to double over the next few years. Recent contract wins and global expansion plan if executed well could turn it into a growth company. Technically it has retraced to a key support level at 3.48. This blog expect 1Q result to be good given the positive guidance last quarter. Could rise to 3.60 in the short term on positive results

All posts and charts are for educational and illustration purposes only

Wednesday, May 2, 2018

DBS - Could have peaked at 31.20. Time To Be Cautious!

DBS - This tradeplan is showing DBS could have peaked at 31.25 and is poised to retrace to 30.00, 28.80 and 27.00

All posts and charts are for educational and illustration purposes only

Tuesday, May 1, 2018

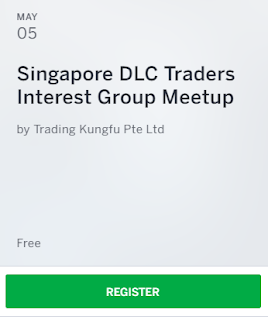

DLC Traders Interest Group Meet Up - 5 May 18

I would like to invite everyone to join me on the 5 May, Saturday afternoon for the DLC (Direct Leverage Certificates) event at SGX. I will be sharing with everyone on the trading opportunity DLC offers in spite of the quiet market in the Singapore Market. I will also be sharing how you could follow my DLC trades.

The DLC tracks the Hang Seng index. Being the most volatile index in the world, the Hang Seng Index offers trading opportunities for short and long term. I will be giving an short outlook of the China market.

We have also catered afternoon tea for everyone during the break . Please register and join me next Saturday. I believe this event will bring a new angle and an alternative to trading and Investment in the Singapore market.

Robin Ho

The DLC tracks the Hang Seng index. Being the most volatile index in the world, the Hang Seng Index offers trading opportunities for short and long term. I will be giving an short outlook of the China market.

We have also catered afternoon tea for everyone during the break . Please register and join me next Saturday. I believe this event will bring a new angle and an alternative to trading and Investment in the Singapore market.

Robin Ho

All posts and charts are for educational and illustration purposes only

Subscribe to:

Posts (Atom)