WTI Crude Oil - WTI is poised to break out of its 3 months consolidation

Inflation finally slows! Does that mean that the market has found its bottom?

Inflation finally slows!

Wall Street closed sharply higher as signs of peaking inflation and consumer resiliency sent investors into the long holiday weekend with growing optimism that the Federal Reserve will be able to tighten monetary policy without tipping the economy into recession. Does that mean that the market has found its bottom?

In the 12 months through April, the PCE price index advanced 6.3% after jumping 6.6% in March.

The annual PCE price index increase is slowing as last year's large gains drop out of the calculation.

Excluding the volatile food and energy components, the PCE price index gained 0.3%, rising by the same margin for three straight months. The so-called core PCE price index increased 4.9% year-on-year in April, the smallest gain since last December, after rising 5.2% in March. It was the second straight month that the rate of increase in the annual core PCE price index decelerated. This inflation measure is the most followed by economists and policymakers.

Inflation past the peak?

Inflation has pass the peak but it will remain stubbornly high. I remain confident that crude oil recent consolidation is getting ready for another parabola spike up to 140 d/b.

Substantial declines in the annual rate of inflation are unlikely to materialise until there are significant improvements in geopolitical tensions (that would get energy prices lower), supply chain strains and labour market shortages. Unfortunately, there is little sign of any of this happening anytime soon – The Russia-Ukraine conflict shows no end in sight, Chinese lockdowns will continue to impact the global economy.

At the moment consumer demand is firm and businesses have pricing power, meaning that they can pass higher costs onto their customers.

Housing will keep inflation high

The housing components, accounting for more than 30% of the CPI basket, are not likely to turn lower soon. The housing market remains red hot and this feeds through into primary rents and owners’ equivalent rent (OER) components of inflation with a lag of around 12-18 months.

Rent contracts are typically only changed once a year when your contract is renewed so it takes time to feed through.

Fed under political pressure to curb inflation

This situation intensifies the pressure on the Fed to hike interest rates. This potentially means aggressive rate hikes and the risks of a marked slowdown/recession.

The Federal Reserve remains, for now at least, under political pressure to tighten with the poll this month which shows that Americans remain far more concerned about inflation than any other issue. A total of 70% of Americans view inflation as “a very big problem”

And the empirical evidence shows that the Fed in the post-Volcker era has been increasingly sensitive to such political pressures. It is certainly not easy for Fed to talk dovish when the executive and legislative arms of government want to curb inflation as a top priority especially ahead of the mid term election.

Valuation Looks Compelling But Is It Time To Buy?

Time to start buying ? Valuation is tempting after the meltdown.

US shares took at beating with Nasdaq 100 down 30 % and S&P testing the 20% bear market benchmark. Valuation looks compelling but is it time to buy?

United States Private Consumption accounted for 68.3 % of its Nominal GDP in Mar 2022.

Shares of U.S. retailers and consumer-oriented stocks took a beating last week on worries about whether surging inflation will continue to hurt corporate bottom-lines and cause shoppers to cut back.

Last week, consumer staples dived 8.6% and consumer discretionary tumbled 7.4%, the biggest declines of any S&P 500 sectors, with inflation hammering corporate results. Shares of some companies fared far worse, with Walmart down 19.5% for the week and Target down 29% after disappointing results.

We are beginning to see Investors consumers cut spending in the face of higher prices. This is happening sooner than what most on Wall Street are anticipating .

I think we are only at the beginning of people cutting down spending and changing their spending patterns.

The latest consumer price index jumped 8.3% on an annual basis. Prices for gasoline stand more than 50% higher than a year ago, according to AAA.

Gasoline prices are scaling new high while oil prices has stubbornly stay above the 100 dollar/ barrel mark will keep undermining consumer spending.

A survey by Morgan Stanley found that more than half of consumers plan to cut spending over the next six months due to inflation.

The slump in share prices has made valuations and risk/reward more tempting but we to see evidence of ebbing inflation before we start bottom fishing .

Private consumption makes up 68 % of the US economy , when consumer cuts back spending US and the world is going into recession. This bear market has more downside , it’s not time to get into stocks yet .

Robin is pleased to announce the launching of RHO DLC Trader Group and RHO DLC Discussion Telegram Group (15 May 2022)

To help out those who are keen but new and inexperience in trading DLCs, Robin is pleased to announce that he will be launching two new telegram chat groups where he will be sharing his DLC insights and trade ideas.

What You Need To Know About This Bear Market

Dow and S&P are racing to bear market territory.

Watch for 20%: Market cycles are measured from peak to trough, so a stock index officially reaches bear territory when the closing price drops at least 20% from its most recent high (whereas a correction is a drop of 10%-19.9%). A new bull market begins when the closing price gains 20% from its low.

I have learnt in my 35 years in the stock market that when the macro turns and the market corrects, the weak get weaker.

Always choose to short the weaker sector like the Nasdaq and Russell because they fall faster .

Dow Jones is down 13% from the peak, S&P 500 17.5% , Nasdaq 100 down 27.6% and Russell 2000 down 28.6% from its peak

Stocks lose 36% on average in a bear market.

We are not there yet.

Bear markets tend to be short-lived. The average length of a bear market is 289 days, or about 9.6 months.

We are not there yet.

Every 3.6 years: That’s the long-term average frequency between bear markets. Though many consider the bull market that start after the great financial crisis in 2008 and ended in 2021 to be the longest on record.

Here’s is the danger , the longest bull market may begat an exceptionally long bear market much longer than the average 289 days .

This bear market still has Legs to go further and longer .

Amazon (Nasdaq: AMZN) - Well defined long-term trendline that stretches back to 2017 is suggesting that Amazon heading lower towards 2215 and prehaps 2035.

On 2 May 2022 (Monday), this trade plan on Amazon (Nasdaq: AMZN) was posted on my Telegram Stock Chat Group when the stock was at 2,485.

Last night, Amazon (Nasdaq: AMZN) traded at a low of 2,159 (down more than 5%) and has hit my first target at 2,215 before closing at 2,175. The stock is down more than 12% since this trade plan was posted.

Russell 2000 Index (10 May 2022)

On May 6 2022 (last Friday), this trade plan on Russell 2000 Index was posted on my Telegram Stock Chat Group when the index was at 1,871.

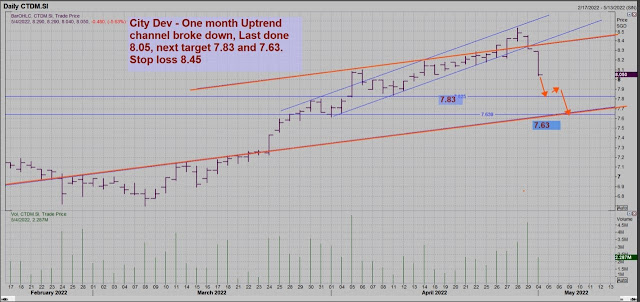

City Dev (SGX:C09) – One month uptrend channel broke down.

On May 4 2022 (last Wednesday), this trade plan on City Dev (SGX:C09) was posted on my Telegram Stock Chat Group when the stock was at 8.05.

This Is Why I Continue To Believe This Bear Market On Growth Stocks Is In Its Early Innings

TINA - A common refrain since the March 2009 market low has been “there is no alternative” (TINA) — a catchphrase used as justification for buying stocks amidst ever higher price-to-earnings multiples where treasury yield are close to zero .

Benchmark Treasury yields definitively broke above 3%, moving further above their four-decade downtrend which intimates a new era has begun. A cold look at the long-term chart shows the next obvious stop should be around 4% The higher yields go, the more appealing they become for many investors and increased fears of a global recession suggests that some may soon consider returning to bonds.

Tina has reversed so has the “buy on dip strategy”. In the recent months “ Sell into strength” has overtaken “buying into dip” as a dominant and profitable strategy . The continuing weakness of the Treasury bond market, in the face of a hawkish Fed, is the best evidence of stagflationary concerns. It has also reconfirmed the death of risk parity with bonds and equities both down year to date in America. The S&P500 has declined by 9.4% on a total-return basis year-to-date, while the Bloomberg US Long-term (10Y+) Treasury Bond Index is down 19% . The longer this state of affairs continues, the more likely it is to trigger severe collateral financial damage somewhere. A Hawkish Fed trying to regain credibility remains plain bearish for growth stocks which is why, I have been so bearish on Nasdaq. The forward price-earnings gap between the MSCI AC World Growth Index and its value equivalent has come back down to around 10 points, having reached as high as 16 points in January last year. The bad news is that the long-term average valuation gap between global growth and value shares is about 5 P/E points, something which suggests the premium still has room to shrink even further.

Another danger lurking on the horizon for equities is a growing risk of mass redemptions from ETFs with the sell-off exacerbated by the reality that everybody owns the same stocks (Fanngs) because of the socialist monstrosity know as passive investment or “indexation”. This is why I continues to believe this bear market on Growth stocks is in its early innings .