All posts and charts are for educational and illustration purposes only

Friday, December 29, 2017

US Dollar Weakness - Creepy

The market had expected that passing of the Trump's US Reform Tax will mean the USD will rally more and the US yield curve will steepen further, instead we are seeing a creepy USD weakness and the US yield curve flattening with the US 10 Year treasury yield coming down. The markets are clearly showing scepticism about the long term stimulative effects of Trumponomics trade. This blog base case on the dollar index is that sooner rather than later to test will test its 3 year low at 91.0, This will trigger more fund flow to Asia and the emerging markets. This blog remain a bearish on the dollar maintaining a sell into strength until the Dollar Index hit 0.91.

Thursday, December 21, 2017

US 10 Year Yields Treasury Climbed To 9 Month High

US 10 Years hits 9 months high and the chart looks like climbing higher staying firmly above the 100 days MA. The yield is at 2.49% , if it hits the year high at 2.62, the Reits, Telcos and yield stocks will start to hurt , rising rates while boosting the banks will cause Technology shares to come under profit taking. The rise in yield is caused by the passage of the US reform tax bill in anticipation for faster economic growth and added supply of bonds to finance the impending budget deficit. If energy prices which is inflationary continues to rise bond yields will continue to accelerate upwards.

All posts and charts are for educational and illustration purposes only

Friday, December 15, 2017

China Growth and Regulatory Scare - China Market Could Be Heading Down Going Into The New Year

China could face a short term sell off caused by China’s deleveraging campaign with

the renewed squeeze of the shadow banking sector implemented following the Party Congress in October. It

has caused the 10-year renminbi

government bond yield rising to 3.93% on

Wednesday. The aim is to squeeze out shadowy loans and encourage more loan growth

to the real economy. China Securities Regulatory Commission (CSRC) recently

suspended approval of new mutual funds that plan to allocate more than 80% of

their portfolio to Hong Kong-listed equities. It could result in a short term cooling of South Bound fund inflows, further

aggravating by the normal seasonal decline in A share trading volume in the run

up to Chinese New Year in 16 February.

Indeed that growth scare has already begun, The Caixin/Markit

manufacturing Purchasing Managers' Index came in at 50.8 for last month — the

lowest level in five months Economists in a Reuters poll had expected the index

to read 50.9 for November, lower than 51.0 the previous month.

On 27 Nov, this blog predicted that the Shanghai A Index

has peaked and is due for a sharp correction just from a technical perspective

. Indeed the Shanghai Stock Exchange A Index (SSE A) underperforming the MSCI

Asia Index and trading at a 5 month low. The SSE A index has broke its uptrend

channel line, with immediate support at 3445 , its is likely to trend lower in

the near term towards 3355 and it will drag the Hang Seng lower.

All posts and charts are for educational and illustration purposes only

Friday, December 8, 2017

Metastock Xenith Platform - 9 Dec 2017

Hi there!

I will be organising a MetaStock XENITH Platform Training session on 9 December 2017.

Details of the session below:

In this session, Kian Ann will cover more in-depth on how to use the different applications within MetaStock XENITH, including:

The session is free, so do come on down to learn more about the power of MetaStock XENITH.

If you have attended this training before, you can re-attend as a refresher.

You can register for the session here: https://www.tradingkungfu.com/xpt

I will be organising a MetaStock XENITH Platform Training session on 9 December 2017.

Details of the session below:

- Date: 9 December 2017 (Saturday)

- Time: 9am - 12pm

- Venue: International Plaza #36-05A

In this session, Kian Ann will cover more in-depth on how to use the different applications within MetaStock XENITH, including:

- Monitor

- Charts

- News

- Time and Sales

- Company Overview

- Economic Monitor

- Rebasing Chart... and more

The session is free, so do come on down to learn more about the power of MetaStock XENITH.

If you have attended this training before, you can re-attend as a refresher.

You can register for the session here: https://www.tradingkungfu.com/xpt

All posts and charts are for educational and illustration purposes only

Thursday, December 7, 2017

Santa Claus Rally or Year End Meltdown?

The traditional year end buying could mean that the "Santa Claus Rally" is still on the cards.

However, the selling pressure of late for technology stocks may continue, as after taking a closer look at the Republican tax bill, tech companies could be hit harder by the corporate Alternate Minimum Tax (AMT). This measure was removed from the House tax rule, but included in the Senate bill, and it must be resolved before the overall plan is passed.

A lot of stocks could be dumped in late December in order to be taxed under the old rules if the House bill keeps these penalties in place.

However, the selling pressure of late for technology stocks may continue, as after taking a closer look at the Republican tax bill, tech companies could be hit harder by the corporate Alternate Minimum Tax (AMT). This measure was removed from the House tax rule, but included in the Senate bill, and it must be resolved before the overall plan is passed.

A lot of stocks could be dumped in late December in order to be taxed under the old rules if the House bill keeps these penalties in place.

All posts and charts are for educational and illustration purposes only

Wednesday, December 6, 2017

Metastock XENITH Platform Training

Hi there!

I will be organising a MetaStock XENITH Platform Training session on 9 December 2017.

Details of the session below:

In this session, Kian Ann will cover more in-depth on how to use the different applications within MetaStock XENITH, including:

The session is free, so do come on down to learn more about the power of MetaStock XENITH.

If you have attended this training before, you can re-attend as a refresher.

You can register for the session here: https://www.tradingkungfu.com/xpt

I will be organising a MetaStock XENITH Platform Training session on 9 December 2017.

Details of the session below:

- Date: 9 December 2017 (Saturday)

- Time: 9am - 12pm

- Venue: International Plaza #36-05A

In this session, Kian Ann will cover more in-depth on how to use the different applications within MetaStock XENITH, including:

- Monitor

- Charts

- News

- Time and Sales

- Company Overview

- Economic Monitor

- Rebasing Chart... and more

The session is free, so do come on down to learn more about the power of MetaStock XENITH.

If you have attended this training before, you can re-attend as a refresher.

You can register for the session here: https://www.tradingkungfu.com/xpt

All posts and charts are for educational and illustration purposes only

Friday, December 1, 2017

Tuan Sing - Strong FA but TA Points To a Correction

Tuan Sing - UOB Kay Hian initiated a "Buy" recommendation yesterday with a target price of 0.71 representing a upside target of more tan 70%. The report cited the potential of its huge $2.3 billion property portfolio in Spore and Australia bought a fire sales price and it is trading at 61.2%discount to RNAV and 52% of its book value. The fundamental reasons to buy this stock looks compelling and many investors jumped in to buy in the last 2 days as evident in the massive volume traded which was the highest 2 days volume in the last 3 years.

The Price Action, however suggest that this stock could have peaked in the short term and is likely to correct to 0.43 before it could attempt higher prices.

If the 0.43 level is breached the stock could head south towards 0.36 which will present and excellent opportunity for traders to buy for a good rebound.

All posts and charts are for educational and illustration purposes only

Wednesday, November 29, 2017

Yangzijiang - Testing the 50 Days Moving Average Again . Will it give way?

Yangzijiang - Testing the 50 Days Moving Average Again! Since beginning of the year been the 50 days MA has proven to be a reliable support. This time round Price Action is suggesting that it could be breached. The next crucial support is 1.48 and 1.40 respectively.

All posts and charts are for educational and illustration purposes only

Monday, November 27, 2017

Shanghai A share Index - Sign of Topping Out In the Short Term

Uptrend breached today! Asia market especially Hang Seng has been tracking the Shanghai A share index closely lately. More weakness ahead for China A shares does not augur well for the regional stocks indices.

All posts and charts are for educational and illustration purposes only

Jumbo - Earnings below estimate , higher dividend did not help share price

Jumbo - FY 17 earnings below estimates dampened by higher operating cost. Faster expansion plan incurring higher capex will be a key risk if it fails to deliver growth. The increased dividend to 1.2c did not help to boost the sentiment. On the charts , its heading for its next support at 0.525 and a break below this level will take the share price down to 0.47.

All posts and charts are for educational and illustration purposes only

DLC Webcast for the Week of 27 Nov 2017

Robin's weekly DLC webcast for the week of 27 November in collaboration with Soc Gen is online!

You can watch it via this link:

https://www.tradingkungfu.com/livetrading/

All posts and charts are for educational and illustration purposes only

Wednesday, November 22, 2017

Monday, November 20, 2017

Robin's Weekly Webcast about Hang Seng Index with the DLC

Robin's weekly DLC webcast in collaboration with Soc Gen is online!

You can watch it via this link:

https://www.tradingkungfu.com/livetrading/

All posts and charts are for educational and illustration purposes only

Monday, November 13, 2017

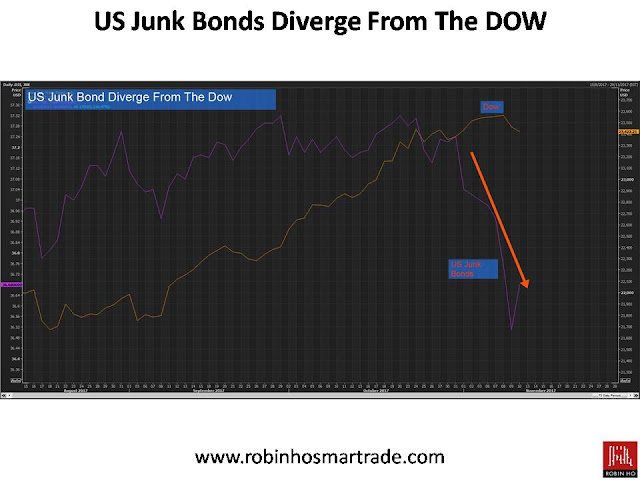

Junk Bonds Collapsed, Diverging From Dow - Another Canary In The Coal Mine?

Junk Bonds and Stocks are usually positively correlated, or move in the same direction, because Junk Bonds are considered a proxy for risk appetite in the market. It started to diverge in late October. Is it another canary in the coal mine - an ominous sign of an impending market correction coming?

All posts and charts are for educational and illustration purposes only

Watch Robin's Hang Seng Index DLC Webcast Online

Robin's second DLC webcast in collaboration with Soc Gen is online! You can check out the video via the link below to watch Robin share his views about Hang Seng Index.

The next webcast will be taking place Monday at 1pm. Stay tuned!

All posts and charts are for educational and illustration purposes only

Thursday, November 9, 2017

Best World - Prediction on 7 Nov was Spot On

Two days ago, this blog predicted that Best World could correct to 1.25. Today Best World's closing price is 1.26.

Best World's 5-minute chart shows that its price moved almost exactly according to the 7 November trade plan published in this blog post.

All posts and charts are for educational and illustration purposes only

Wednesday, November 8, 2017

Weekly SocGen DLC Webcast Starring Robin Ho

Robin will be live every Monday, sharing his views on the Hang Seng Index as well as the Singapore MSCI Index! Be sure to watch it here:

www.tradingkungfu.com/livetrading/

All posts and charts are for educational and illustration purposes only

Russell 2000 and Dow Diverge

Russell 2000 and Dow Diverge. Ïs it "A canary In A Coal Mine" Syndrome? The Small Caps has started to gave way while the Big Blues are forming tops!

All posts and charts are for educational and illustration purposes only

Tuesday, November 7, 2017

Best World - Weakness Before 3Q results tomorrow. Buying opportunity or an "Ominous"Sign?

Best World - . In August this stock survived a China Goverment crackdown on "Pyramid Scheme" . After plunging from 1.64 to 0.95, its has since recovered to 1.50. Today, it fell ahead of 3Q results on 8 Nov due after trading hour. Is this another "Flushed" the BB is using to collect more stock for a good set of results or an " Ominous" sign of bad news in the making?

Well, from the price action today things certain don't look promising with selling persisting throughout the day on significantly high volume of 9m shares . This weakness came on a bullish backdrop with STI gaining nearly 1%. From the charts , it close below its strong support of 1.42 and could head towards its next stop at 1.30 and 1.25. If the results is significantly below expectation 1.10 is on the cards.

A spillover of the China's campaign on illegal pyramid schemes and high Capex cost from building new manufacturing plants could cause a drag to its revenue.

Well, from the price action today things certain don't look promising with selling persisting throughout the day on significantly high volume of 9m shares . This weakness came on a bullish backdrop with STI gaining nearly 1%. From the charts , it close below its strong support of 1.42 and could head towards its next stop at 1.30 and 1.25. If the results is significantly below expectation 1.10 is on the cards.

A spillover of the China's campaign on illegal pyramid schemes and high Capex cost from building new manufacturing plants could cause a drag to its revenue.

All posts and charts are for educational and illustration purposes only

Monday, November 6, 2017

DLC Live Webcast with Robin - HSI and SIMSCI Outlook

*Update:

The first live interview with Soc Gen went smoothly! If you have missed the live webcast, you can still watch the 10 minute video via the same link below.

Robin will be sharing his views on the program every Monday at 1pm, so stay tuned!

Robin will be sharing his views about Hang Seng and SIMSCI on Societe Generale Webcast today! You can watch the web streaming here at about 1pm:

All posts and charts are for educational and illustration purposes only

Friday, November 3, 2017

CityNeon - Excitement Over Jurassic World Could Be Over

Cityneon - Excitement over Jurassic World , the Mighty Avengers and Transformer property rights may be coming to an end. Price action suggest BB made exit between 1.20-1.22. A break below 1.12 will trigger an acceleration to 1.075 and eventually 0.98.

All posts and charts are for educational and illustration purposes only

Wednesday, November 1, 2017

ISDN - A Laggard Engineering Solutions Play Ready For Rebound

ISDN - A laggard integrated engineering solution play with Foxconn and AEM as their major customers. The group is a market leader in motion control with high barrier of entry. It is also a beneficiary of the One Belt One Road project linked with state owned companies. 3Q results is due in mid Nov On the chart it seems to have found a bottom at 0.23 and ready to break out of its consolidation zone between 0.23 and 0.26. A break above 0.26 could see the stock accelerate towards 0.285 and 0.31.

All posts and charts are for educational and illustration purposes only

Monday, October 30, 2017

Country Garden 2007.hk - Technicals On the Charts Looks Toppish

Sales cooling off, Technicals on the charts looks toppish!

All posts and charts are for educational and illustration purposes only

Thursday, October 26, 2017

Daily Opportunities with Robin Ho. Register now!

All posts and charts are for educational and illustration purposes only

Wednesday, October 25, 2017

Alliance Mineral - Consolidating for the Next Break

Alliance Mineral - Recent news flow has been very positive. The company reported that they have been approached by a number of parties to explore a potential transaction which may involve the ordinary shares of the company. This will hold up the share price and will be a potential catalyst for the share price. In addition, according to the latest report from Burwill, the lithium concentrate purchased at fixed price for the first two years will increase by approximately 40% compared to the original offtake amount. From the chart, the near term support is 0.365, and the share price is consolidating for the next push to break the last high of 0.425 and subsequently towards 0.44.

All posts and charts are for educational and illustration purposes only

Tuesday, October 24, 2017

Market Outlook For 4th Quarter 2017

Great turnout on Saturday at my quarterly market outlook! The 500 seater auditorium was almost full. I would like to thank everyone who bought tickets to support this event. I was especially encouraged by one participant who forgot about the event while holidaying in Krabi, so she cut short her holiday and bought an early ticket back to catch the event. Hope to see everyone again on 3 Feb 2018 for the next market outlook! God bless! ~Robin Ho

Here are some photos and testimonial videos from Saturday!

Photography by Yun You

Here are some photos and testimonial videos from Saturday!

Photography by Yun You

Testimonial by Shawn

Testimonial by Isaac

Next Market Outlook will be on 3 Feb 2018. See you there!

Registration Link :

All posts and charts are for educational and illustration purposes only

Thursday, October 12, 2017

Second Chance - Most volume traded since 2012! Something Brewing?

Second Chance - Something brewing? Today we witnessed the most heavily traded day in this stock since 2012. 2nd Chance owns 17 retail shops City Paza , with Enbloc fever now raging, could City Plaza be next on the block? As the site is very close to Paya Lebar MRT , it is an attractive target for developer. It all depends on whether City Development which owns 30% of the total value of City Plaza agrees to the idea. On the chart ,the first resistance at 0.28 which was touched today, the 2nd resistance is at 0.30 followed by 0.33. Interesting this stock has a warrant which closed today at 0.15. The exercise price of the warrant is at 0.25 which is "Ìn The Money". If this stock goes to 0.305, the warrant could double in price. What's the game plan of the BB ? This blog will be watching this stock, stay tuned!

All posts and charts are for educational and illustration purposes only

Staying Ahead Of The Crowd With Price & Volume Trading Strategies: Powered by MetaStock XENITH!

Robin will be conducting a free training session this Saturday (14 October 2017) on how he trades Price Action and Volume strategies using MetaStock XENITH!

|

|

|

|

All posts and charts are for educational and illustration purposes only

Friday, October 6, 2017

Dow - Correction Is Imminent

Dow - This tradeplan is indicating a correction in the next 1-2 weeeks is imminent and it could bring Dow to 22600 and 22420

All posts and charts are for educational and illustration purposes only

Metastock Xenith Platform Training

I will be organising a MetaStock XENITH Platform Training session this coming Saturday 7 October 2017, from 9:30am - 12:30pm at International Plaza, Level 36. Kian Ann will be conducting the training.

In this session, we will cover more in-depth on how to use the different applications within MetaStock XENITH, including:

... and more

The session is free, so do come on down to learn how you can maximise your XENITH subscription.

If you have attended this training before, you can re-attend as a refresher.

You can register for the session here: https://www.tradingkungfu.com/xenithtraining

In this session, we will cover more in-depth on how to use the different applications within MetaStock XENITH, including:

- Quote List (and how to transition to the more powerful Monitor app)

- Charts

- News

- Time and Sales

- Company Overview

- Economic Monitor

- Rebasing Chart

... and more

The session is free, so do come on down to learn how you can maximise your XENITH subscription.

If you have attended this training before, you can re-attend as a refresher.

You can register for the session here: https://www.tradingkungfu.com/xenithtraining

All posts and charts are for educational and illustration purposes only

Wednesday, October 4, 2017

SIA Engineering - Structural damage on the chart

SIA Engineering - Down 7 % on heavy volume today and nobody really know the reason. Some attributed to JP Morgan seeking to sell its entire stake to raise 128m. There is market talk of investors selling ahead of Guruda's GMF IPO , its lower operating cost is a threat to SIA engineering operations. There was also talk of market concern about the appointment of new CFO appointed on 29 Sep. The company say they are not aware of any reason in reply to Sgx queries. On the charts , today's price action its a structural damage. On the longer term it is headed for 3.04 and 2.75 respectively.

All posts and charts are for educational and illustration purposes only

Comfort Delgro - All The King's Horses And Men Cannot Pull ComfortDelgro Together Again!

All the king's horses and men cannot pull ComfortDelgro together again! Stock rebound from UOB and Maybank Kim Eng upgrade to 2.35 was short lived. Selling resumed after the stock hit a high of 2.10. With the short covering over, and the real selling resuming, this stock is on route to 1.89.

All posts and charts are for educational and illustration purposes only

Monday, October 2, 2017

KSH - Successful Execution of Gaobeidian Project Could Be The Next Catalyst

KSH - Next catalyst will come from news of Gaobeidian project. Successful execution of the launch of its project will lead to an upgrade of the stock price. This stock has been consolidating since August after hitting a high of 0.86 in July. The consolidation is likely coming to an end soon and the stock could make another attempt at the high again. On the near term it could rebound to 0.80.

All posts and charts are for educational and illustration purposes only

Hong Leong Asia - Rebound underway!

After a relentless slide since hitting a high of 1.43 in February, this stock went to a low of 0.86. A rebound to 0.98 and 1.01 is on the cards.

All posts and charts are for educational and illustration purposes only

Wednesday, September 27, 2017

Alliance Mineral - Broke Out of its Downtrend for the first time since April

Alliance Mineral - This stock was trader's favourite when it rose from 0.10 to 0.43 in Apr , it went into a tailspin when the debt problem between the CEO and Jonathan Lim surfaced. This debt problem will soon blow over and trader's will soon refocus on the fundamentals of the company. Next month the company is expected to announce the resource upgrade of Ball Hill which could see the extension of the life of the mine which will warrant an upgrade. China move towards faster adoption of Electric Vechicle targets will increased the demand for lithium dramatically augurs well for the company.

On the charts, the stock has broke out of its downtrend and for the first time moved above the 50 days MA. This is a signal of a short term reversal that could take the stock higher.

A strong support has been estabilised at 0.255, the next resistance is 0.315 and 0.34 respectively.

On the charts, the stock has broke out of its downtrend and for the first time moved above the 50 days MA. This is a signal of a short term reversal that could take the stock higher.

A strong support has been estabilised at 0.255, the next resistance is 0.315 and 0.34 respectively.

All posts and charts are for educational and illustration purposes only

Friday, September 22, 2017

DBS - Head and Shoulders In the Making?

DBS - Head and Shoulders Pattern in the making? Broke and stayed below 50 days MA, a break below key support at $20.00 would form a reversal Head and Shoulder and a topping out pattern that will trigger a downside target to 19.25 and 18.50 respectively!

All posts and charts are for educational and illustration purposes only

US markets celebrates new high but No Joy In STI

US Markets celebrates new highs but no joy with STI. This week new highs in US markets have been met with a bearish divergence in the STI. In the regional markets STI and the ASX200 display the weakest technical profile. STI has broke below the 50 days MA as well as the lower boundary of the uptrend channel. The uptrend in STI that we saw since Dec 2016 is now in doubt and a break below 3200 will open the door to a downside target of 3150 and 3110 respectively. At the meantime, STI is expected trade within the 3210 , 3225 and 3245 range. This blog will turn bullish on STI only when it breaks above 3250.

All posts and charts are for educational and illustration purposes only

Thursday, September 21, 2017

GL Ltd - Turning Around After 4 Years Downtrend

GL Ltd. (Guocoleisure) - Could finally be turning around after a 4 years downtrend on worries of Brexit, weak Pound and depressed oil sector. In May 2014 , this stock went to a high of 1.20 on privitisation rumours. With Brexit near settlement, oil sector bottoming out and the Pound recent spectacular recovery, it stock could be beginning to turn around. The charts is showing huge accumulation at 0.72 levels, at 0.76 today it has climbed to stay above the 50 days MA and broke above its downtrend channel, which potentially points to an upside target of 0.82 and 0.92 respectively.

All posts and charts are for educational and illustration purposes only

Friday, September 15, 2017

Where is the stock market heading? Watch the Dollar!

Where is the market headed? Watch the Dollar!

Global Markets rally remains a counter dollar rally. The Dollar Index briefly broke its 3 years low (91.8) touching 91.01 before rebounding to trade above. The dollar weakness reflects the faltering confidence of Trump's ability to deliver tax reform. The US house speaker Paul Ryan has announced that the reform tax outline will be announced on the week on 25th Sept. If investors renew their believe that the reform tax can make America Great again, it will be the best chance for a Dollar rally. A Dollar resurgence will be detrimental to the market. A break above 93 in the dollar index could trigger a huge technical rebound on the upside to 97.5. Watch the week of 25th Sept!

Global Markets rally remains a counter dollar rally. The Dollar Index briefly broke its 3 years low (91.8) touching 91.01 before rebounding to trade above. The dollar weakness reflects the faltering confidence of Trump's ability to deliver tax reform. The US house speaker Paul Ryan has announced that the reform tax outline will be announced on the week on 25th Sept. If investors renew their believe that the reform tax can make America Great again, it will be the best chance for a Dollar rally. A Dollar resurgence will be detrimental to the market. A break above 93 in the dollar index could trigger a huge technical rebound on the upside to 97.5. Watch the week of 25th Sept!

All posts and charts are for educational and illustration purposes only

Subscribe to:

Posts (Atom)

Robin Ho is a top tier Trader and Remisier with PhillipCapital, and is one of Phillip’s most active and successful trader. Having been through the peaks and troughs of the volatile markets, Robin is a well-sought after speaker who shares his in-depth trading knowledge with traders and investors at numerous investment seminars.

Robin Ho is a top tier Trader and Remisier with PhillipCapital, and is one of Phillip’s most active and successful trader. Having been through the peaks and troughs of the volatile markets, Robin is a well-sought after speaker who shares his in-depth trading knowledge with traders and investors at numerous investment seminars.