All posts and charts are for educational and illustration purposes only

Friday, December 27, 2013

Thursday, December 26, 2013

Robin Featured in VnEconomy Online

All posts and charts are for educational and illustration purposes only

Tuesday, December 24, 2013

Monday, December 23, 2013

Friday, December 20, 2013

Thursday, December 19, 2013

USA Celeberate Start Of Tapering , STI Not Excited!

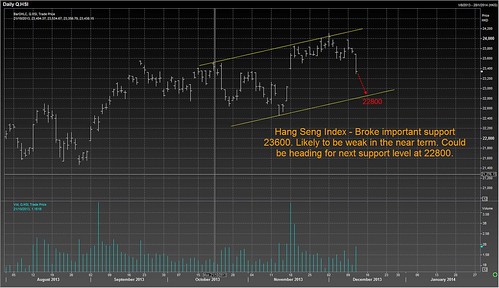

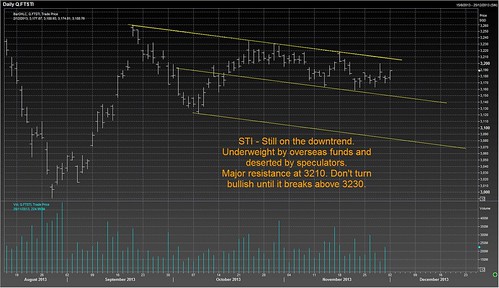

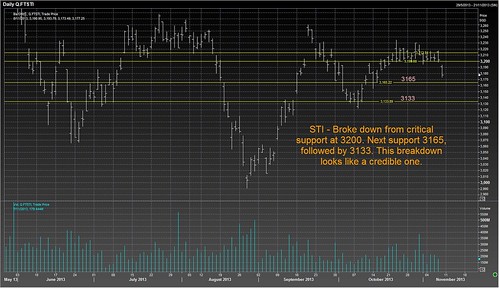

Dow was up 292 pts, STI closed mixed, up only 8 pts due to a sharp reversal in Hang Seng, hitting a high of 23404 at opening only to close at 22888. It was drag down by China short term money rates spiking up for a second day as the PBOC refused to inject liquidity into the market.

Funds flow are clearly favouring the developed markets out of emerging markets.I stay bearish on STI unless it can hold above 3135

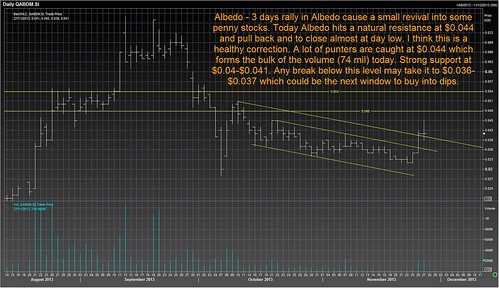

Spore blue chips remained weak with players selling into every rebound. Although the broad market is quiet, some penny stocks are seeing some speculative play coming back.

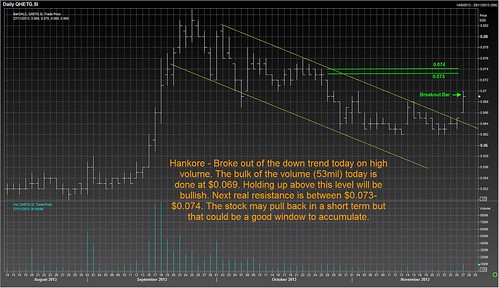

Villianz and Otto Marine spectacular run up is spilling into another penny stocks and traders are begining to feel the sense of speculative fever returning. I like Villianz, Otto, Mermaid, Hankore, EMS, SIIC env. These are the current leaders. The secret to penny stock play is the stay focus on a few winners, don't chase the market, accumulate with the BBs and act on the first break with volume, take some profit off the table and ride the balance of the outstanding position. Hope this penny rally with run till CNY and everyone gets a Hong Pow!

Funds flow are clearly favouring the developed markets out of emerging markets.I stay bearish on STI unless it can hold above 3135

Spore blue chips remained weak with players selling into every rebound. Although the broad market is quiet, some penny stocks are seeing some speculative play coming back.

Villianz and Otto Marine spectacular run up is spilling into another penny stocks and traders are begining to feel the sense of speculative fever returning. I like Villianz, Otto, Mermaid, Hankore, EMS, SIIC env. These are the current leaders. The secret to penny stock play is the stay focus on a few winners, don't chase the market, accumulate with the BBs and act on the first break with volume, take some profit off the table and ride the balance of the outstanding position. Hope this penny rally with run till CNY and everyone gets a Hong Pow!

All posts and charts are for educational and illustration purposes only

Tuesday, December 17, 2013

Robin in Ho Chi Minh - Market Outlook 2014

Robin in Ho Chi Minh - Invited guest speaker for Market Trends 2014 by FPT University / Indonesia Chamber of Commerce Vietnam.

Q&A Session

Organizer - Attended by Julia Santoso, a senior member of the Indonesia Chamber of Commerce

(Julia Santoso - 2nd from the left)

All posts and charts are for educational and illustration purposes only

Robin's Investment Strategies For the Year of the Horse on 25 Jan 2014

Robin was spot on for the Year of the Snake. He was bullish particularly on the US markets and Penny Stocks at the 2013 Market Outook. What is Robin's Investment strategy for 2014? Come and join us to learn more!

EVENT DETAILS:

Date : 25 January 2014 (Saturday)

Time : 9:30am - 12:30pm

Venue : MND Auditorium, (Annex A, Level 2)

5 Maxwell Road Singapore 069110

Ticket Sales : $50 each. Promotion Buddy Discount Tickets (min. 2 pax) at $30 each.

Please click link to purchase ticket http://robinhoyearofthehorse.eventbrite.com/?aff=blog

ENQUIRIES: Call 65050192/99/96 or Email enquiries@cyberquote.com.sg

All posts and charts are for educational and illustration purposes only

Monday, December 16, 2013

Thursday, December 12, 2013

Wednesday, December 11, 2013

Tuesday, December 10, 2013

Monday, December 9, 2013

Market Opinion

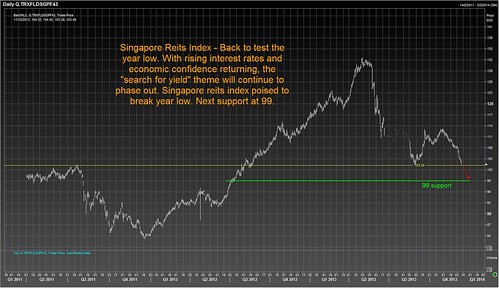

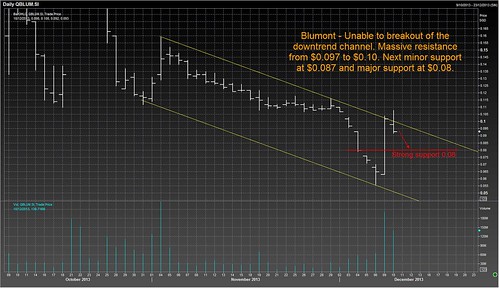

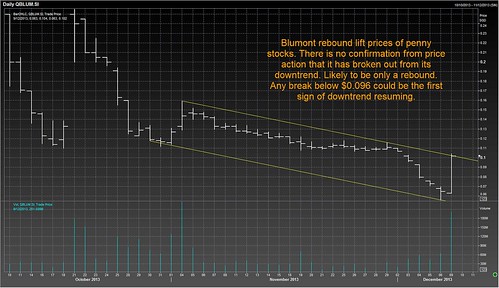

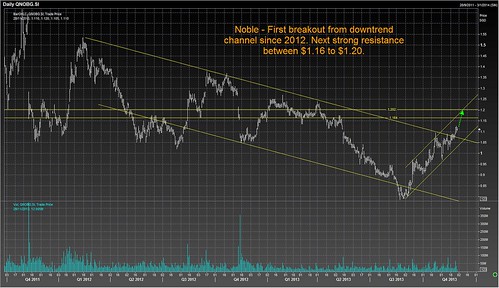

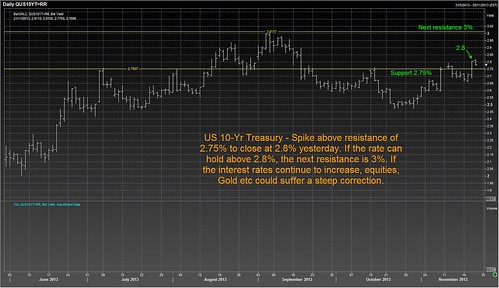

Investors continue to stay away from Singapore market inspite of Dow Jones strong rebound,, favouring Japan and North Asia. The overnight US 10 YT spike to 3 month high of 2.93% did not argur well for Singapore Reits and yield stocks. Blumont's rebound provided some shine to some penny stocks. Vallianz blown up volume seems to indicate a short term peak has been reached, most of the distribution done at 0.132, won't turn bullish until it close above this level. Hankore was particularly strong today but 0.073-0.074 level is a huge resistance. Mermaid continue its strong uptrend on the back of it's good 3Q results, strong support at 0.415, will put a stop at 0.41. Ezra closed high today, could be interesting watch tommorrow, BB may roll over last weeks big volume trade which is due next 2 days!

All posts and charts are for educational and illustration purposes only

Friday, December 6, 2013

Market Opinion

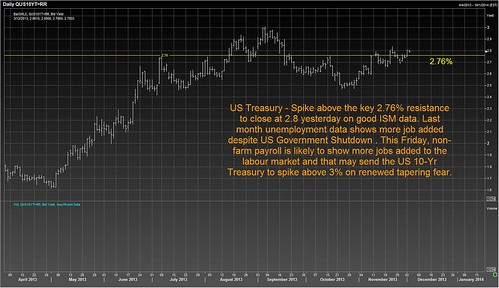

The broad market is bearish and volume continued to be low on selling of Blue Chips. The weakness in Gold and the spike in the US 10Yr Treasury are market expectation of Good Job data tonight. Anything more than 200,000 jobs added will invoke renewed tapering fear.

There are only a couple of stocks that are resilent in the amidst the weak market. Vallianz continue its 4 Days winning streak, Genting Hk rebounded towards the end to close high, Mermaid attracted lots of buying at 0.41 and Ntegrator had a surprisingly last minute buy up to close high!

All posts and charts are for educational and illustration purposes only

Wednesday, December 4, 2013

Tuesday, December 3, 2013

Friday, November 29, 2013

Master The Markets Through Price Volume Action Techniques. Organized by SGX.

These series of courses was the first time I introduced live trading demo as part of the cirriculum. We spent about one hour before the market opened to plan our setups and executed the trades accordingly to our plans after market opened.

Thank God in all three sessions of live trading, the market moved the way we had predicted. I believed the most effective way to learn is to see a experience trader trades live. From the feedback, most students said this is the best part of the course.

All posts and charts are for educational and illustration purposes only

Thursday, November 28, 2013

Monday, November 25, 2013

Friday, November 22, 2013

Thursday, November 21, 2013

QE Taper May Come In - Minutes Of Oct FOMC

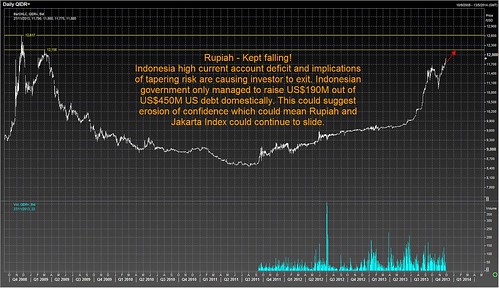

The Market was spooked by FOMC minutes that Fed Reserve official still expect to start cutting back on the US $85bn bond buying programme. There is remote possibility that tapering will happen this year for the following reasons

1.There is no FOMC in Nov and the next FOMC is on 17-18 Dec.

2.Fed is not likely to taper while Bernanke is still in charge till 31 Jan 2014. He chairs his last FOMC in Dec meeting.

3.US debt ceiling due for another round of negotiation in Jan 2014, too close to taper.

The earliest window of tapering could be in Mar 2014 when Yellen takes over.

The key risk remains in more positive economic data which could cause the 10 Yr US treasury to shoot pass 3 pct (the last high) and cause the market to tank.

Another important event to watch is tonight's (21 Nov) US Senate Banking Committee vote on the nomination of Yellen to be Fed Chairman. Yellen needs majority vote to become the 1st woman to lead the Fed.

All posts and charts are for educational and illustration purposes only

Tuesday, November 19, 2013

Student's Testimonial

Dear Robin,

Thankfully to Robin who has since guided

my trading back onto the right track. Your teaching have complemented and

reinforced my understanding in trading, especially in any of the market’s

sentiment. Thank you again.

With best regards,

Raymond Han

19 Nov 2013

All posts and charts are for educational and illustration purposes only

Friday, November 15, 2013

Wednesday, November 13, 2013

Tuesday, November 12, 2013

Monday, November 11, 2013

Friday, November 8, 2013

Wednesday, November 6, 2013

Subscribe to:

Posts (Atom)