All posts and charts are for educational and illustration purposes only

Tuesday, June 30, 2015

Monday, June 29, 2015

Friday, June 26, 2015

SGX Academy - June 2015 Trading Course

SGX Jun 2015 Trading Course – Just completed the most

exciting part of the course which is Live Trading on the Hang Seng Index. Ever

since I introduced Live Trading into the course it has added not only

excitement to the course, I found that the students are able to understand my

trading techniques better when it is demonstrated to them Live.

All posts and charts are for educational and illustration purposes only

Wednesday, June 24, 2015

Monday, June 22, 2015

Robin on EDGE Magazine

It was my honour to be featured on the 15 Jun 15 issue of

the EDGE magazine on the Cover Story with Phillip Capital Chairman Lim Hua Min

in conjunction with Phillip’s 40th Anniversary . I just wish to give

thanks all my Clients , Students , SGX Academy and Cyberquote Pte Ltd who have

been supporting me all these years.

All posts and charts are for educational and illustration purposes only

Friday, June 19, 2015

Thursday, June 18, 2015

Wednesday, June 17, 2015

Tuesday, June 16, 2015

Monday, June 15, 2015

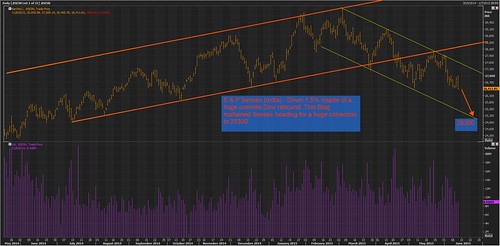

KLCI – Downtrend Continues!

Foreign selling continues

MIDF Equities Research estimates cumulative net foreign outflow in 2015 at RM7.5bil, surpassing the RM6.9bil outflow for the entire 2014.

“Foreign investors have now been net sellers on Bursa for seven consecutive weeks. And for the third week running, the amount offloaded was more than RM850mil a week — the longest undisrupted stretch of ‘intense’ selling so far this year.

“Last week’s selldown increased the cumulative net foreign outflow in 2015 to RM7.5bil, surpassing the RM6.9bil outflow for the entire 2014. We estimate that there is still an overhang of about RM15bil to RM20bil of foreign portfolio liquidity in Bursa,” MIDF Equities Research

1 MDB - The solution to 1MDB’s RM42bn debt equivalent to 4% of GDP is a huge a concern with, weaker Ringgit, capital flight, falling Bank Negara reserves, weak energy prices and political paralysis.

MIDF Equities Research estimates cumulative net foreign outflow in 2015 at RM7.5bil, surpassing the RM6.9bil outflow for the entire 2014.

“Foreign investors have now been net sellers on Bursa for seven consecutive weeks. And for the third week running, the amount offloaded was more than RM850mil a week — the longest undisrupted stretch of ‘intense’ selling so far this year.

“Last week’s selldown increased the cumulative net foreign outflow in 2015 to RM7.5bil, surpassing the RM6.9bil outflow for the entire 2014. We estimate that there is still an overhang of about RM15bil to RM20bil of foreign portfolio liquidity in Bursa,” MIDF Equities Research

1 MDB - The solution to 1MDB’s RM42bn debt equivalent to 4% of GDP is a huge a concern with, weaker Ringgit, capital flight, falling Bank Negara reserves, weak energy prices and political paralysis.

All posts and charts are for educational and illustration purposes only

Thursday, June 11, 2015

Wednesday, June 10, 2015

Tuesday, June 9, 2015

Friday, June 5, 2015

Tuesday, June 2, 2015

Subscribe to:

Posts (Atom)