All posts and charts are for educational and illustration purposes only

Friday, December 27, 2013

Thursday, December 26, 2013

Robin Featured in VnEconomy Online

All posts and charts are for educational and illustration purposes only

Tuesday, December 24, 2013

Monday, December 23, 2013

Friday, December 20, 2013

Thursday, December 19, 2013

USA Celeberate Start Of Tapering , STI Not Excited!

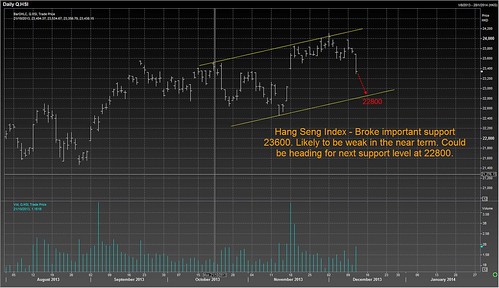

Dow was up 292 pts, STI closed mixed, up only 8 pts due to a sharp reversal in Hang Seng, hitting a high of 23404 at opening only to close at 22888. It was drag down by China short term money rates spiking up for a second day as the PBOC refused to inject liquidity into the market.

Funds flow are clearly favouring the developed markets out of emerging markets.I stay bearish on STI unless it can hold above 3135

Spore blue chips remained weak with players selling into every rebound. Although the broad market is quiet, some penny stocks are seeing some speculative play coming back.

Villianz and Otto Marine spectacular run up is spilling into another penny stocks and traders are begining to feel the sense of speculative fever returning. I like Villianz, Otto, Mermaid, Hankore, EMS, SIIC env. These are the current leaders. The secret to penny stock play is the stay focus on a few winners, don't chase the market, accumulate with the BBs and act on the first break with volume, take some profit off the table and ride the balance of the outstanding position. Hope this penny rally with run till CNY and everyone gets a Hong Pow!

Funds flow are clearly favouring the developed markets out of emerging markets.I stay bearish on STI unless it can hold above 3135

Spore blue chips remained weak with players selling into every rebound. Although the broad market is quiet, some penny stocks are seeing some speculative play coming back.

Villianz and Otto Marine spectacular run up is spilling into another penny stocks and traders are begining to feel the sense of speculative fever returning. I like Villianz, Otto, Mermaid, Hankore, EMS, SIIC env. These are the current leaders. The secret to penny stock play is the stay focus on a few winners, don't chase the market, accumulate with the BBs and act on the first break with volume, take some profit off the table and ride the balance of the outstanding position. Hope this penny rally with run till CNY and everyone gets a Hong Pow!

All posts and charts are for educational and illustration purposes only

Tuesday, December 17, 2013

Robin in Ho Chi Minh - Market Outlook 2014

Robin in Ho Chi Minh - Invited guest speaker for Market Trends 2014 by FPT University / Indonesia Chamber of Commerce Vietnam.

Q&A Session

Organizer - Attended by Julia Santoso, a senior member of the Indonesia Chamber of Commerce

(Julia Santoso - 2nd from the left)

All posts and charts are for educational and illustration purposes only

Robin's Investment Strategies For the Year of the Horse on 25 Jan 2014

Robin was spot on for the Year of the Snake. He was bullish particularly on the US markets and Penny Stocks at the 2013 Market Outook. What is Robin's Investment strategy for 2014? Come and join us to learn more!

EVENT DETAILS:

Date : 25 January 2014 (Saturday)

Time : 9:30am - 12:30pm

Venue : MND Auditorium, (Annex A, Level 2)

5 Maxwell Road Singapore 069110

Ticket Sales : $50 each. Promotion Buddy Discount Tickets (min. 2 pax) at $30 each.

Please click link to purchase ticket http://robinhoyearofthehorse.eventbrite.com/?aff=blog

ENQUIRIES: Call 65050192/99/96 or Email enquiries@cyberquote.com.sg

All posts and charts are for educational and illustration purposes only

Monday, December 16, 2013

Thursday, December 12, 2013

Wednesday, December 11, 2013

Tuesday, December 10, 2013

Monday, December 9, 2013

Market Opinion

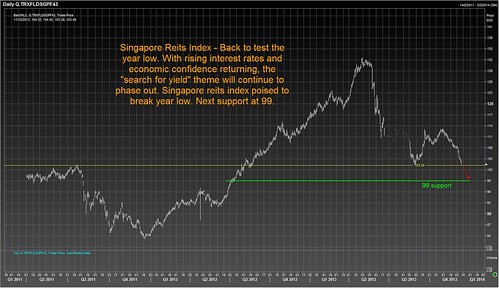

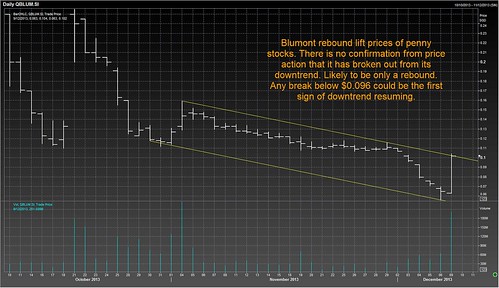

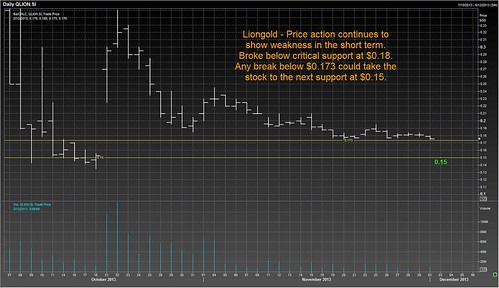

Investors continue to stay away from Singapore market inspite of Dow Jones strong rebound,, favouring Japan and North Asia. The overnight US 10 YT spike to 3 month high of 2.93% did not argur well for Singapore Reits and yield stocks. Blumont's rebound provided some shine to some penny stocks. Vallianz blown up volume seems to indicate a short term peak has been reached, most of the distribution done at 0.132, won't turn bullish until it close above this level. Hankore was particularly strong today but 0.073-0.074 level is a huge resistance. Mermaid continue its strong uptrend on the back of it's good 3Q results, strong support at 0.415, will put a stop at 0.41. Ezra closed high today, could be interesting watch tommorrow, BB may roll over last weeks big volume trade which is due next 2 days!

All posts and charts are for educational and illustration purposes only

Friday, December 6, 2013

Market Opinion

The broad market is bearish and volume continued to be low on selling of Blue Chips. The weakness in Gold and the spike in the US 10Yr Treasury are market expectation of Good Job data tonight. Anything more than 200,000 jobs added will invoke renewed tapering fear.

There are only a couple of stocks that are resilent in the amidst the weak market. Vallianz continue its 4 Days winning streak, Genting Hk rebounded towards the end to close high, Mermaid attracted lots of buying at 0.41 and Ntegrator had a surprisingly last minute buy up to close high!

All posts and charts are for educational and illustration purposes only

Wednesday, December 4, 2013

Tuesday, December 3, 2013

Subscribe to:

Comments (Atom)