All posts and charts are for educational and illustration purposes only

Thursday, July 30, 2015

Tuesday, July 28, 2015

Monday, July 27, 2015

US Interest rates – FOMC 28-29 July

US Interest rates – FOMC 28-29 July

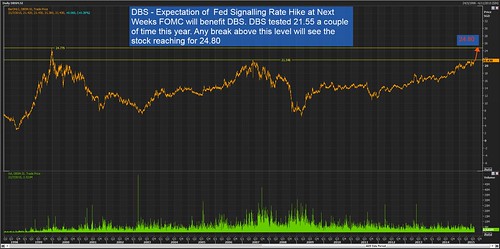

FOMC meets on 28-29 Jul to chart the course on US interest rates.

Will a rise in US interest rates cause investments to tumble?

Even the mere prospect of the Federal Reserve raising interest rates will sent a shock to US markets due to a lack of liquidity – so what can investors expect when policymakers begin to raise interest rates for the first time since 2008?Fed-watching has become an even more intense since Yellen has been hinting of rate hike more frequently recently.

Many analyst are saying interest rate hikes really aren’t all that terrifying. They’re right, if you judge only by looking at what has happened historically. Here’s the difference this time round. The last time the Fed raised interest rates – a decade ago – the world was a very different place. Nouriel Roubini points out, we’re in a world where there’s a lot less liquidity. That means when the market gets a shock – and even the mere prospect of the Fed raising rates has delivered a shock to the system – the lack of liquidity will cause the market to collapse much faster

Liquidity is the key risk today because banks have reduced their “market making” activities that once helped support prices when market tumble.. Today regulators don’t want banks loading up their balance sheets with all kinds of risky securities when their primary business isn’t to trade for themselves but to facilitate transactions for others, so they’ve made it more costly and difficult to do so. But those new rules and changes have had some unintended consequences for liquidity. Liquidity is vital because it takes a toll on prices. In the US Treasury bond market – which is supposed to be one of the most liquid markets in the world – if there’s no one willing to buy your securities, the price simply collapses.

But what does that mean for both you and I? It means that the value of your investment is likely to swing far more violently as the news flow becomes more apparent about the timing and magnitude of the Fed’s plans for interest rates. Hold off your major purchase till after the FOMC!

We could face some bumpy times in stocks ! It just means that we need to buckle our seatbelts and prepare for what is likely to be a very bumpy ride if Fed announces the rate hike this week!

Take a look at your portfolio and make sure you’re comfortable with the level of risk you’re taking. The coming weeks won’t be easy.

All posts and charts are for educational and illustration purposes only

Friday, July 24, 2015

Wednesday, July 22, 2015

Tuesday, July 21, 2015

Thursday, July 16, 2015

ROBIN KAKAOTALK TRADERS CHAT GROUP GATHERING - Trading Strategy Update and Market Update

On 11 July I organized the first get-together for the

Chatgroup. I updated members with my Trading Strategy and shared the current

market trend. This Chatgroup consisting of my clients and students had only 50

people when it was first established in early 2014. Today it had grown to 303

people. It started off as a means of mentoring my students and keeping my

clients current with the stock market happenings. Today, it is one of the most

active traders’s chatgroup because many of the members are active traders and

some fulltime traders. These members helped to contribute timely and relevant

market information and stock analysis that comes `Live` which makes trading

real, dynamic and exciting. The members shares ideas and trading strategies and

we all learn from one another. Thank you to all members for making this

chatgroup a great source of help !

All posts and charts are for educational and illustration purposes only

Thursday, July 9, 2015

Wednesday, July 8, 2015

Tuesday, July 7, 2015

Thursday, July 2, 2015

Subscribe to:

Comments (Atom)